The cashflow statement, explained

Cash is king. You probably heard that one before, and for companies, it does hold some truth.

Cash is the amount of money a company has at hand. It is used to acquire material, buy services, pay salaries and all other things needed to operate a business. That’s why running out of cash can be dangerous for organizations.

Although not as dramatic, having ‘too much’ cash is also not recommended. The reason is that cash is a means, it enables economic actors to exchange goods and services: when it’s “sleeping”, so is its potential to help the business improve.

For a company to thrive, cash management is therefore about finding the right balance between what is earned – inflows –, how much is spent – outflows – and how it is spent.

To visualize these flows – and the ‘how’ – companies used the cashflow statement.

What is the cashflow statement?

From an accounting perspective, cashflow incorporates not only money, but also cash equivalents – assets that can quickly be turned into cash, such as stocks or debts – which are either generated or spent over a specific period.

It’s important to differentiate cash from profit, though: the latter is the amount of money that is left, once all expenses have been deducted from the sales revenue. On paper, it could be that your expenses are lower than your revenue, which means you are profitable, but if you have not collected your payment yet, cash is missing, despite your theoretical profitability.

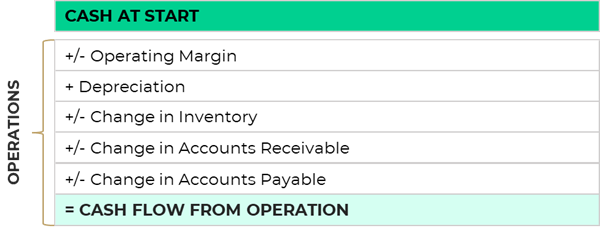

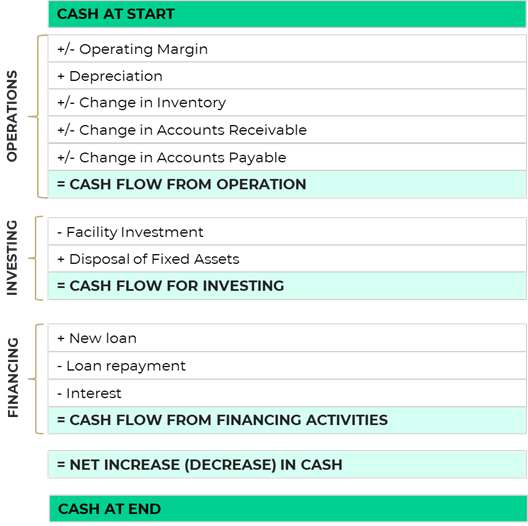

Cash can be generated and spent in several different ways. To keep clarity, the cash flow statement is divided into three sections: cashflow from operations, cashflow from financing, and cashflow from investing.

Each of the three sections gives an overview of the sources of cash, how it is spent, and the net variation in cash during a period, for the given category.

Cash flow from operations

The starting point of a cashflow analysis is know how much cash the organization holds at the beginning of a given period (e.g., on January 1) – that’s the “cash at start”.

Then, we can add and deduct the elements linked to the period. So, the operating cash flow of the year 2021 will not include expenses from 2020, unless they were paid in cash in 2021.

The operating cash flow focuses on elements directly linked with producing and selling goods or services, and it gives insights on the company’s ability to pay its bills and operating expenses. For a business to be viable in the future, more cash inflows are needed than cash outflows.

These include the operating margin (EBIT), the depreciation, changes in inventory (decrease or increase if you are building up inventory or selling part of it), changes in accounts receivable and accounts payable (invoices that have been paid to suppliers, or by customers).

This section is especially useful in differentiating sales from cash received: although the company generates a large sale, which boosts revenue and earnings, there won’t be a cash inflow until the payment has been collected from the customer! The better a company is at collecting payments, the more cash inflows. Reversely, your cash position might be great after collecting payments from customers, but what if you still haven’t paid your suppliers…

The operating cashflow is therefore very helpful in assessing how efficient a business is at generating cash from its sales revenue.

Cash flow from investing

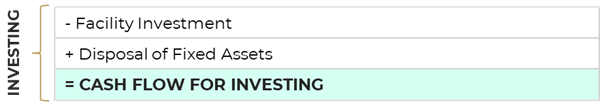

Cash can also be generated from – or spent on – investing activities. Investments include purchases and sales of physical – e.g., property, plant, and equipment – or financial assets – e.g., securities. In that case, financial assets belong to another organization and are seen as investments, not financing.

A negative cash flow from investing is not per se a warning sign: it can result from investments – e.g., in research and development – which improve the business’ performance and long-term health. However, the volume of investments is worth paying attention to: if the business invests a lot but is not generating cash, it can be a warning sign about the investment itself.

In our simulations, investments are essentially in physical assets, which is why the only possible positive inflow is through disposal of fixed assets, but in a real-life scenario, a positive inflow could be from dividends or financial yields linked to financial assets in another organization.

Cash flow from financing

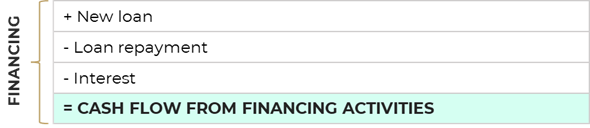

The financing cash flow focuses on the flows that help the company fund itself: these include inflows and outflows related to debts, issuing, buying back shares, and paying dividends. In that case, shares are issued by the organization.

This section provides valuable insight regarding the company’s financial strength and how well its capital structure is managed.

Why you should pay attention to your cashflow

The cashflow statement is therefore a powerful tool to assess where cash is coming from and going to, in which amount, at which timing, and at which uncertainty level. For that matter, it is an essential part of financial reporting, and it provides valuable insights into a company’s overall financial performance.

In our business simulations, when participants make decisions for their fictional company, said decisions can only be validated when the forecasted cash is positive or equals zero: our take is that, although profitability is not achievable or necessary from the start, the cash position is extremely important and impactful for organizations, as it conditions their capacity to run their operations and grow.

The ultimate learning point is the difference between profit and cash flow.

If you are curious how we assess company performance in our games, contact us to receive a demo access, or let’s talk!

Sources

- Schwarz, L. (2022, February 28). Cash Flow Analysis: Basics, Benefits and How to Do It. Oracle NetSuite. Accessible here.

- What Is Cash Flow? (2021, December 2). Investopedia. Accessible here.